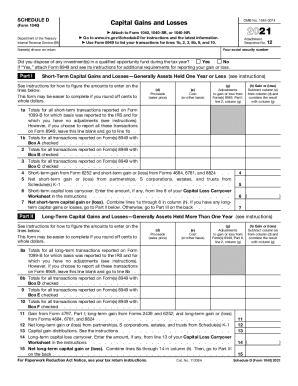

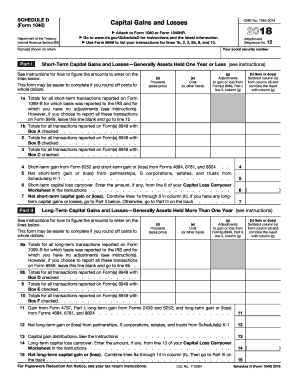

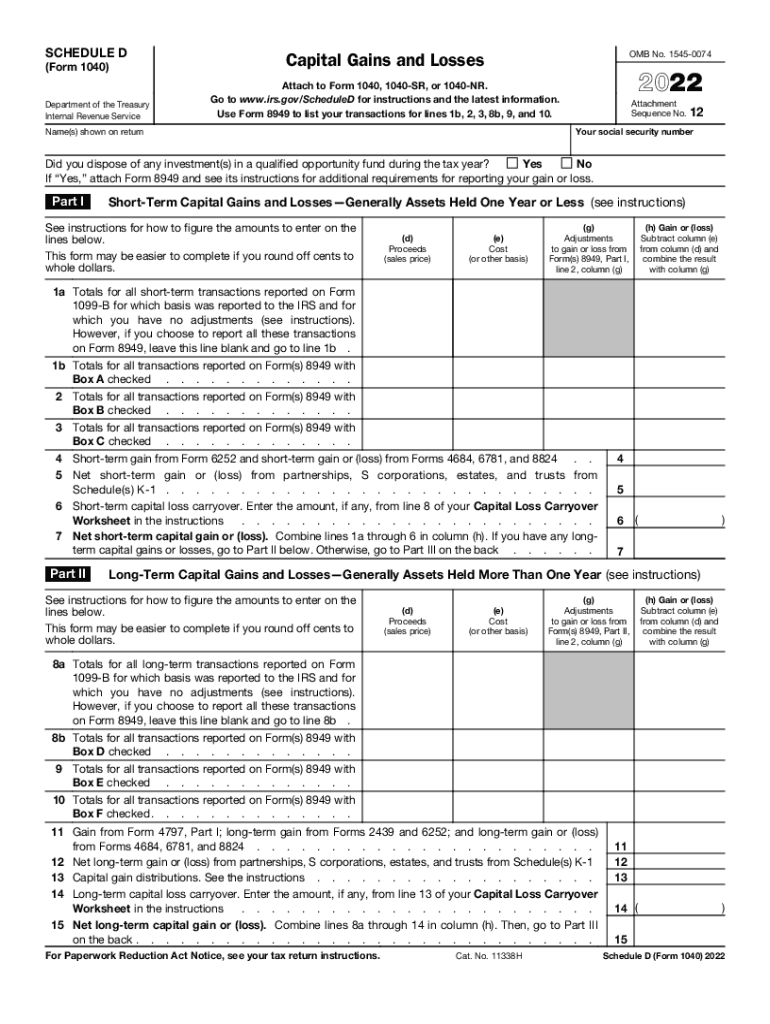

2024 Form Schedule D 1040 – Schedule D Capital Assets The Schedule D form tells In order to complete this worksheet, you will need to complete Form 1040 through line 43 to calculate your taxable income. . to figure their capital gain or loss on the transaction and then report it on Schedule D (Form 1040), Capital Gains and Losses. A taxpayer who disposed of any digital asset by gift may be required to .

2024 Form Schedule D 1040

Source : www.investopedia.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgIRS Schedule D (1040 form) | pdfFiller

Source : www.pdffiller.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comIRS Schedule D (1040 form) | pdfFiller

Source : www.pdffiller.comComparing Different Business Structures and Their Tax Implications

Source : www.traact.com2022 1040 schedule d: Fill out & sign online | DocHub

Source : www.dochub.comForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.zaSchedule D Tax 2014 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comD1204 Form 1040 Schedule D Capital Gains and Losses Greatland.com

Source : www.greatland.com2024 Form Schedule D 1040 What Is Schedule D: Capital Gains and Losses?: Form 8949, that some taxpayers will have to file along with their Schedule D and 1040 forms. Whenever you sell a capital asset held for personal use at a gain, you need to calculate how much money . Hiring a CPA to do my taxes was worth the cost, but when they made a mistake on my tax return, I found out the hard way that they aren’t perfect. .

]]>:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-bce9771cbe94498ab34d6b9107e208de.png)